Mike Tang’s 2016 Predictions – Rise of the Chinese Dragon

By Mike Tang, Guest Writer

When people say “mainstream gaming,” most would presume that it’s based in South Korea or Japan. Both nations have had a significant influence on videogame culture and have brought competitive gaming to the world stage; however, there is one dark horse (or in this case, red) that has quickly solidified its status as the king of the gaming market – China.

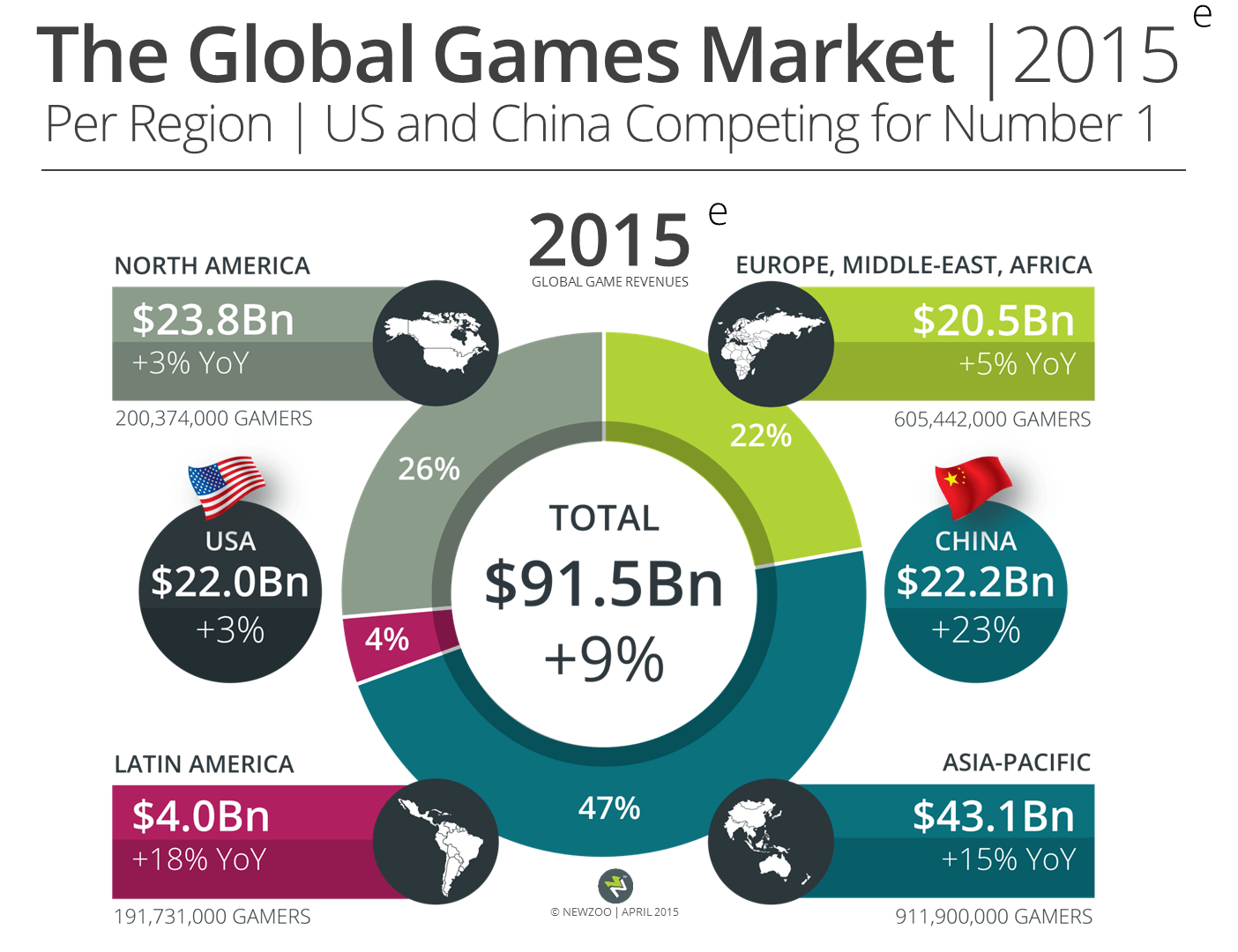

In a 2015 report by the research firm Newzoo, China has the largest gaming market in the world. At the end of 2016, it pulled in a whopping $22.2 billion with a year-to-year growth of +23% since 2014. That tops the USA’s $22 billion with only a +3% year-to-year growth. China can still be considered the “new kid on the block,” however; it’s hard to deny the depth of its coffers and the significant influence on the market (in recent years and in the near future). With this newfound clout, what are China’s intentions and how will it affect the global gaming economy?

Firstly, and quite obviously, China has a population of over 1.3 billion. Gamers account for an estimated 1 out of every 3 Chinese citizens. This gives China the ability to cater to local and international gaming markets, making it easy to acquire new audiences with existing contents from abroad and scale up quickly. The large pool would also mean that there will be millions of consumers and producers, making a boom in tech, art and design in the industry.

In 2000, the Chinese government lifted the ban on personal ownership of gaming consoles. The major console manufacturers (i.e. Sony, Microsoft and Nintendo) wasted no time in making substantial investments in console production for the legion of Chinese consumers.

Over 100,000 Xbox One units were sold on the first day of its release in China, making its debut better received than in Japan. Microsoft will use this momentum to capture the recently “opened” console market with an extensive marketing campaign, localization of their gaming libraries and big PR ploys using local celebrities (from Hong Kong and the mainland) to brand the Xbox One as the definitive console to have. Since the release of the new generation of consoles, Microsoft has not yet been able to close the major gap between the numbers of Xbox One units sold to the number of Sony’s PlayStation 4 units sold. Not daunted by its limited initial success, Microsoft has set its sights on the promising and budding Chinese market, so as to gain as much ground as possible before its competitors can intervene.

In spite of the console ban, Sony and Nintendo already had a strong brand presence in China. To compete, Microsoft will have to step up their marketing efforts and be more aggressive in a space where the Chinese are accustomed to playing computer games in internet cafes. On the other hand, it will be an uphill battle for the Japanese companies, since past and recent disputes have led to bad blood between the Japanese and Chinese governments. It will be interesting to see which new laws and regulations are placed on imported consoles and business in the coming months and how the console manufacturers adapt to them.

Home console systems are reported to have generated over $400 million and it will continue to increase in the near future. Curiously, the Chinese consoles are slightly marked up in comparison to their North American counterparts, which are also manufactured and assembled in China. Sony’s PS4 is priced at 2,899 yuan or about $468 USD, while it costs only $350 in the USA. The pricing difference is the same with the Nintendo and Microsoft consoles. On that note, it would be wiser for the console owners to lower their price points, since China is already obsessed with PC gaming, which is mostly free to play.

With the influx of console games, it is expected for the government to start regulating which content enters the country and ultimately what the public has access to. Restrictions in China have been lessened, but only to a certain extent. Government-related issues, sex, and violence are still at the top of the list of heavily censored content; however, there are opportunities for game developers to add new features, gameplay, and plot content to better suit the sensibilities of the target audience.

PC gaming is the dominating force in China. It had the greatest revenue generation at around $4.3 billion in the first half of 2015 with a 4.5% growth, according to Tech In Asia. Major players in this space are Riot’s own behemoth, “League of Legends,” South Korea’s “Dungeon & Fighter” and “Crossfire” and the long running MMORPG, “World of Warcraft.” Other “top 10” titles from abroad are: “Guild Wars 2,” “Blade & Soul,” “World of Tanks” and even the 2014 released “Hearthstone.” Domestic games like “Demigods and Semi Devils” and “Fantasy Journey to the West 2” are among the hottest PC games in China. While the domestic titles aren’t ranked higher compared to some of their imported counterparts, it does show growing interest in more local and regional products.

When one has a large sum of money, it is only natural to feel the need to spend it. That is what Tencent, the Chinese Internet Company, did. They own over 90% stake in Riot, the major investor for Blizzard Activision and Epic Games. This investment is in foreign gaming companies and it has paid off handsomely, thus far. The Chinese exclusive edition of Call of Duty Online shows the results of the partnership, and there will be more to come. Expect more cross pollination among the different companies where they will share of best business and game practice. Look forward to hearing news of more acquisitions of companies.

With China securing the biggest market in the world, there will be greater domestic development, as well as greater influence on gaming systems made abroad. International companies will continue to invest and establish themselves within the country. China will continue to shift its one-time “manufacturer of the world” image into a consumer powerhouse and immensely successful producer with the aid of the fastest growing middle class. In time, it won’t be a surprise that some of consumers’ favorite products will be Chinese sourced and made, including successful Chinese based games and gaming systems.

Articles You May Enjoy

- The Elder Scrolls Online Launches Today

- Today marks the official release of The Elder Scrolls Online, ZeniMax Online Studio's MMORPG set in the massive worlds of the Elder Scrol...

- Happy 10th Anniversary for PlanetSide 1

- As a thank you to those veterans, every former PlanetSide 1 subscriber will be granted 6 months of PlanetSide 1 membership absolutely free!